5.00 out of 14 votes

Ultimate Money-Saving Guide for Single Moms and Dads in 2025

Updated 13 min read

Taking care of a family is tough, not to mention an expensive job, especially if you’re raising kids on your own. While making ends meet can be challenging, there are numerous available financial resources for single parents that can help you save money while providing for your children’s needs.

Whether you’ve recently become a single mom or single dad or have been one for quite some time, our comprehensive guide aims to assist single parents in making financial responsibilities more manageable.

Single Parents Statistics

According to the Pew Research Center, a single-parent household is one where a sole adult is living with at least one child—be they biological, step, or foster—under 18 years old.

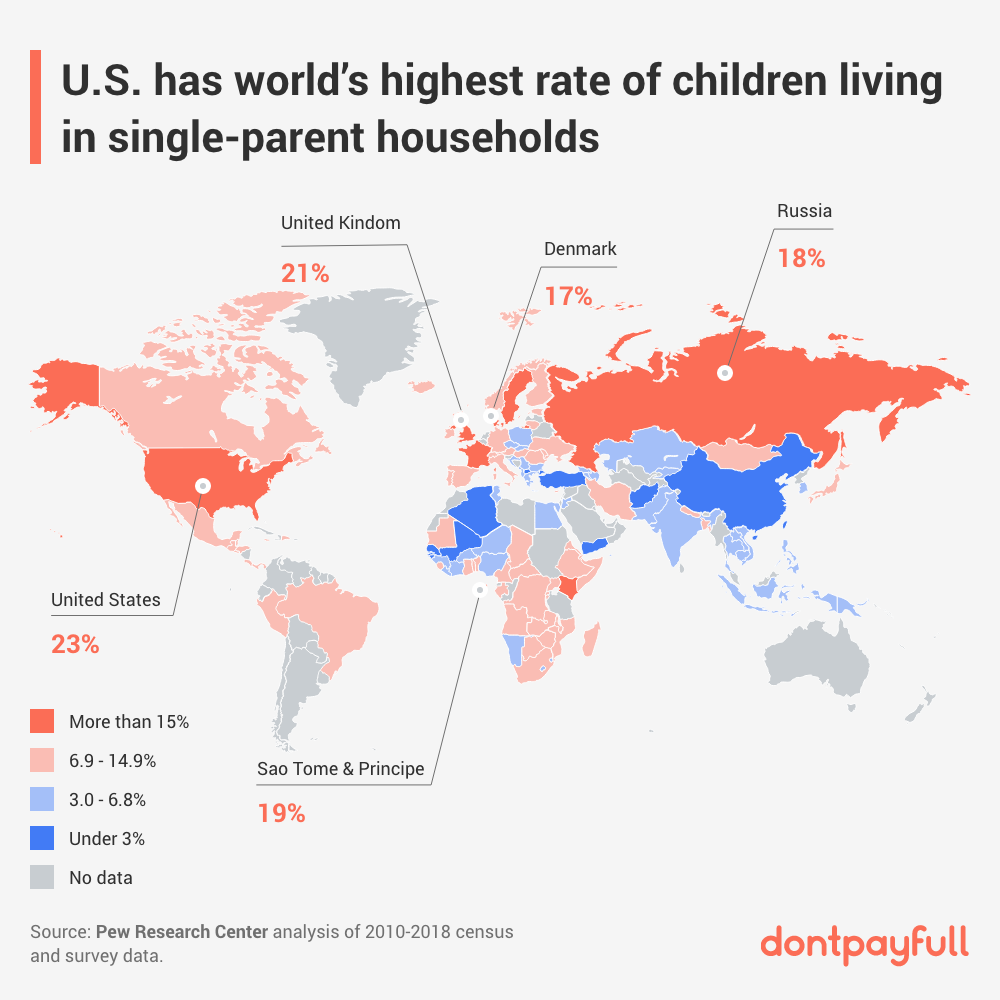

Over the decades, there’s been a rise of single-parent households, with the U.S., among 130 countries, having the highest rate of children living in single-parent homes.

23 percent of children under the age of 18 live with one parent, in contrast to Canada’s 15 percent and China’s 3 percent. That’s about 11 million households in the U.S. And, unlike in other countries, there’s less likelihood of U.S. children living under an extended family setup.

In 1984, Ronald Reagan proclaimed March 21 as National Single Parent Day to recognize single parents for the amount of effort, sacrifice, and devotion involved in raising children without a partner.

Single parents face a lot of stress and can often feel overwhelmed with different responsibilities, including caring for their children and keeping up with financial obligations. Some are faced with fewer opportunities to spend time with their children.

Basic Personal Finance 101 for Single Parents

One of the most effective ways to save money as a single parent is knowing and having control of your personal finances, including your budget for different expenses and your debt.

Understanding how you spend your money will help you get a clearer picture of your financial health and create a sound financial plan. You can prioritize the essential expenditures, such as utilities and groceries, and limit unnecessary purchases.

Monitor Your Debt

When left unchecked, debt can throw your financial plans into disarray. Monitoring how much you owe takes a lot of time and hard work, but it’s essential as a single mom or single dad.

Here are some financial tips that can help you keep track of your debt:

✓ Use the Traditional Route

Following the snowball method, write down all of your debts, including any loans or credit card bills, from smallest to largest.

From there, make the minimum payment for these debts, except for the one with the smallest balance; use any extra money you might have to pay off the smallest balance as quickly as possible. Do the same thing for the next debt with the smallest balance on the list.

When it comes to paying off debt, there are other options available. You can opt to pay off debts with the highest interest rates first, or, if you have some extra cash, focus on one debt and try to pay off more than the minimum payment needed.

✓ Use Debt Management Apps

If pen and paper isn’t your thing, try using apps that can help you manage your debts, such as Debt Manager and ChangEd.

Set a Budget

Aside from being able to pay off debt, one way to take control of your finances as a single parent is to maintain a budget.

Yes, it can be difficult to stick to a budget, especially if you have to juggle a lot of financial obligations and living expenses, but doing so can help you pay off debt and have set aside for emergencies or even for a family vacation.

✓ Determine Your Monthly Income

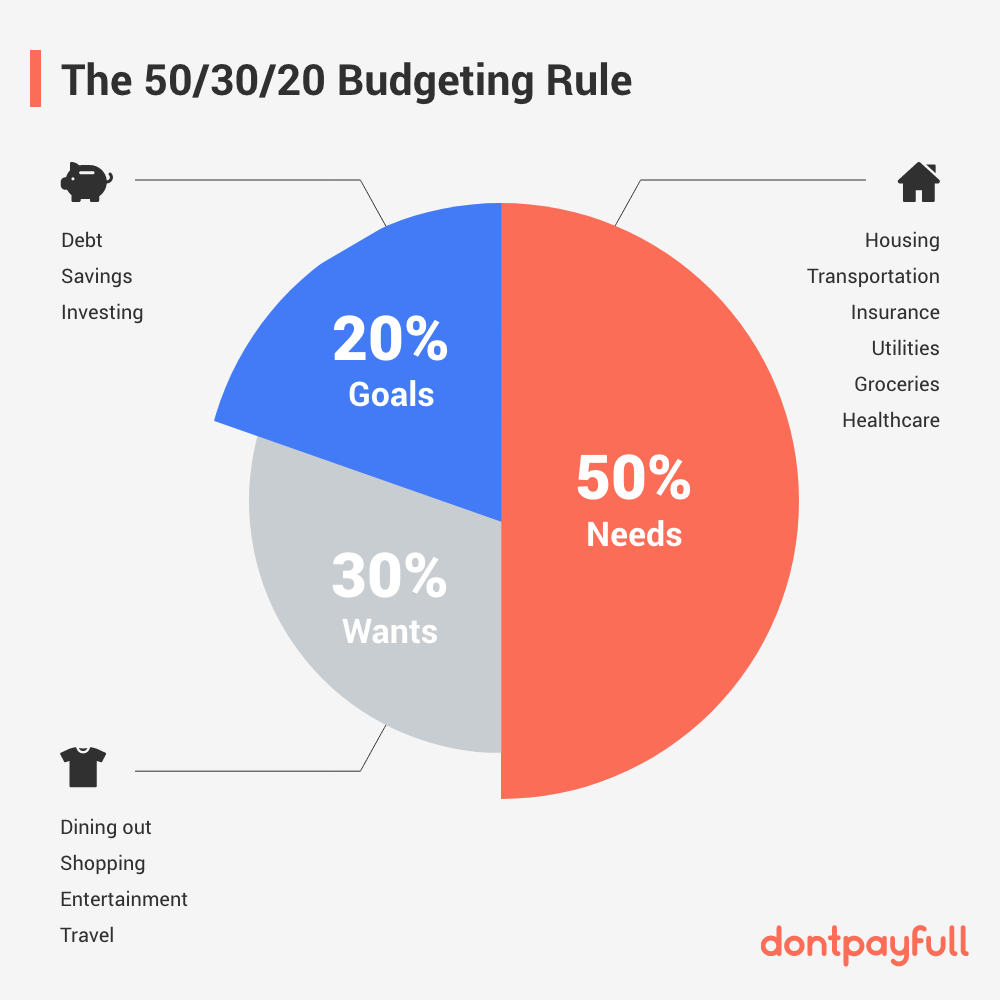

Find out how much income you receive every month, including child support. A good rule of thumb for budgeting is 50-30-20.

- 50 percent of your income is allotted to housing, bills, and food

- 30 percent is set aside for any miscellaneous or extra expenses

- 20 percent should be used for a savings account or to pay off debt

✓ Check Your Credit Card Debt

Credit card interest rates and fees can add to your debt. Try to avoid relying too much on credit cards when spending.

If you’re finding it difficult to manage your credit card debt, the National Foundation for Credit Counseling offers free or low-cost assistance from certified financial counselors.

✓ Use Tools to Make Budgeting Easier

You can go old school and follow the ever-reliable envelope system, or you can opt to use free or affordable apps or programs, such as Mint, and Trim, that’ll help save or keep track of your budget.

For single parents, it’s important to stay on top of your finances.

Make sure that you closely monitor all of your accounts and check for any fraud or incorrect charges that may set you back. Staying informed of your financial situation is one of the best ways to save money as a single parent

Set Up a Retirement Plan

Yes, single moms and dads are entitled to a retirement plan.

See if your workplace has a retirement plan set up for its employees. If there’s none available, you can set up your own retirement account and automate the deposits, much like a 401 (k) or 403 (b).

Increase Net Worth

Increasing personal net worth can help single parents meet their financial responsibilities.

Your net worth is the total of what you own including any investments and assets you might have, and subtracting all the debts and loans.

One way to increase your net worth is by setting up a savings account. You can start small—try saving up to 20 percent of your income. You can also start with as little as $25 per month. The important thing is being able to set extra money aside for rainy days.

Tax Savings for Single Moms and Dads

Additionally, it pays to know about the tax benefits that you’re entitled to as a single parent.

- You can files as “Head of Household” on your tax return.

As head of household, you’ll be paying fewer taxes and have the opportunity to claim a higher standard deduction, provided that you meet certain criteria.

- Earned Income Tax Credit

Single-parent households with low to moderate-income can apply for the Earned Income Tax Credit (EITC) to avail of a tax break.

- Child and Dependent Care Credit

If you’re paying for child care so you can work or look for a job, you’re likely to qualify for this program.

- Child Tax Credit

This tax credit may be worth as much as $2,000, provided that you and your child meet the requirements stipulated by the IRS. For single parents, this is only one of the three child-focused federal tax credits that can help you save on your tax bill.

Grants and Scholarships for Single Parents

Grants and scholarships are available for single parents who are trying to get or finish their education.

- Pell Grants

Pell grants are federal grants given to students from low-income backgrounds. The grant amount can change annually. For the 2024 to 2025 award year, qualified candidates can be awarded up to $7,395.

- Teach Grants

Teach grants are designed to assist individuals who want to become teachers. This grant enables them to get the education they need. Qualified individuals can receive up to $4,000 annually.

Affordable or Free Insurances for Single Parents

One of the best money-saving tips for single moms is availing of affordable or free insurance. This includes health, life, and disability insurance.

Health Insurance

Medicaid is a low-to no-cost health insurance that’s provided by the state. Given that it’s state-administered, eligibility requirements may vary from state to state. However, with the Affordable Health Care Act, many states have since adopted an expanded Medicaid eligibility.

Life Insurance

Life insurance, meanwhile, provides a guarantee that your children will get financial help should anything happen to you. It helps to check with your employer if your company has existing life insurance policies for its employees.

If there’s none in place, do your research before buying a life insurance. Find out how much you need. A good rule of thumb is to go for a life insurance policy that’s 10 times your annual income. Yes, it does seem like a huge investment, but the peace of mind in knowing that you’d be able to provide for your children’s needs even after passing away is worth it.

Disability Insurance

Life insurance, meanwhile, provides a guarantee that your children will get financial help should anything happen to you. It helps to check with your employer if your company has existing life insurance policies for its employees.

If there’s none in place, do your research before buying a life insurance. Find out how much you need. A good rule of thumb is to go for a life insurance policy that’s 10 times your annual income. Yes, it does seem like a huge investment, but the peace of mind in knowing that you’d be able to provide for your children’s needs even after passing away is worth it.

Cash Assistance for Single Parents

Temporary Assistance for Needy Families (TANF) is a federal block grant program offered by the U.S. Department of Health and Human Services that provides supplemental cash to single parent households, provided that they meet certain financial criteria.

To qualify for TANF, single parents with children under six years old must work or participate in job training for a minimum of 20 hours per week. Those with children older than six years old should work or train for at least 30 hours or more.

Food Savings for Single Moms and Dads

Several food programs are available for single parent households:

- Supplemental Nutrition Assistance Program (SNAP)

Also known as food stamps, this program helps eligible persons pay for their food via a debit card system.

- Emergency Food Assistance Program

Available to low-income single-parent households, this program seeks to provide food assistance to families that meet the USDA’s federal guidelines.

- Local food pantries

Local food pantries or food banks offer staples such as pasta, canned goods, and other non-perishable items. Check your area for any food pantry networks if you need assistance in securing supplies.

Home and Housing Savings for Single Parents

The Department of Housing and Urban Development (HUD) offers several housing programs for low-income families via Section 8 housing vouchers provided that they meet certain criteria.

Single moms who find it difficult to pay utility costs can apply for home energy assistance under the Low Income Home Energy Assistance Program (LIHEAP). They can also apply for the Weatherization Assistance Program if they need help for repairs to minimize energy costs at home.

Car Savings for Single Parents

Transportation can get very expensive, especially for single-parent households. The good news is there are a number of programs that can help fulfill your need for basic transportation.

- 1-800-Charity Cars

Low-income single-parent households can request a free used vehicle from 1-800-Charity Cars, which seeks to provide donated used vehicles to families in need.

- Working Cars for Working Families

A program run by the National Consumer Law Center, WCWF gives affordable rates to low-income families so they can afford to finance or purchase a vehicle. To check if there are any local dealers in your area included in this program, check out their website.

Phone and Internet Discounts for Single Parents

Communication is a necessity, but high phone and internet bills can put you off. There are a number of providers that provide discounts for single-parent households.

- Verizon

Verizon’s Lifeline is a government assistance program that provides discounts to low-income customers. You can qualify for this based on your income or your participation in any of the qualifying federal assistance programs.

- AT&T

Access from AT&T can provide affordable internet to qualifying low or limited-income families. If qualified, you can avail of free installation and in-home Wi-Fi, with no deposit and no annual contract.

- Amazon

Qualifying recipients can get up to 50% off on Amazon Prime services.

Shopping and Money-Saving Tips for Single Parents

Grocery shopping can take up a lot of your income if you’re not careful with your expenses. For single moms and dads out there, this is one of the most challenging things to do.

You want to strike a balance between being able to provide for your family without necessarily going over the budget. We’re sharing some of our favorite money saving tips for single moms and dads below:

✓ Learn to prioritize essential items

There are a lot of things that a family needs, but determining which ones are most crucial definitely helps. To do this, ask yourself questions such as “What items should I always have on hand?” or “What essential grocery items can I buy in bulk?” Doing this will not only save you money but also trips to the store.

✓ Create a budget for groceries

Having a grocery budget enables you to spend only on what you need and minimize purchases for things that aren’t as important.

Additionally, set a schedule for grocery shopping. Find a day in the week that works for you and try to stick to that time to avoid unnecessary spending and trips to the grocery.

✓ Find ways to minimize your food waste

Having a ton of unconsumed food translates to wasteful spending. By sticking to a budget and getting only what you need, you’ll not only minimize the amount of food waste you throw out but also cut unnecessary costs.

You can opt to buy frozen goods that you can store for a long while. When getting fresh produce and other perishable food items, it’s best to buy just enough for a week of meals.

Meal planning is also a great way to save money. By knowing what you’re going to be eating for the week, you’ll be able to better plan your grocery list. Plus, you’re more likely to minimize ordering take-outs, which can bloat your expenses.

✓ Use coupons

We know that looking for coupons can be a time-consuming task, but it’ll be worth it because it can actually help you save money. Here at DontPayFull, you can easily get the latest free online coupons and promo codes from top retailers such as Amazon, Walmart, Target, and Best Buy.

✓ Avoid emotional spending

While it might be tempting to appease yourself with a big purchase whenever you’re stressed, sad, or eager to keep up with the latest trends, it’s prudent to carefully think about every non-essential purchase first.

When gauging whether to buy something or not, go over your budget to see if you can afford it. If you can pay with cash to avoid accruing credit card debt.

✓ Keep up to date with your finances

- Take the time every week to check and plan your income and expense flow.

- Identify the bills that need to be paid immediately.

- Review and update your debt list accordingly.

- Check your savings account balance.

- Use this time to plan out your grocery list and budget.

- Think of any upcoming expenses that you might need to make for the coming week.

Being a single parent has its fair share of challenges. It can be difficult to raise a family on your own while trying to meet all of your responsibilities. Fortunately, there are now several resources that are readily available for single-parent households.

While doing research can be time consuming, it is ultimately rewarding, especially when you can use these resources to provide for you and your family.

Do You Have Any Suggestions?

We're always looking for ways to enrich our content on DontPayFull.com. If you have a valuable resource or other suggestion that could enhance our existing content, we would love to hear from you.

Was this content helpful to you?